My commentary on Gartner’s Cloud MQ - 2018

As a true technologist – I am not a favor of analyst reports and in some circles Gartner is a dirty word – but since most of the industry swears by Gartner – I went over the report.

Here are my highlights…(emphasis is mine – not from the source

Most customers have a multicloud strategy. Most customers choose a primary strategic cloud IaaS provider, and some will choose a secondary strategic provider as well. They may also use other providers on a tactical basis for narrow use cases. While it is relatively straightforward to move VM images from one cloud to another, cloud IaaS is not a commodity. <- No shit Sherlock! Each and every cloud wants you using their services and ditching the competition which is why there will never be a standard across clouds.

Customers choose to adopt multiple providers in order to have a broader array of solutions to choose from. Relatively few customers use multicloud architectures (where a single application or workload runs on multiple cloud providers), as these architectures are complex and difficult to implement. <- Damn straight!

Managing multiple cloud IaaS providers is challenging. <- Really?????

Many organizations are facing the challenge of creating standardized policies and procedures, repeatable processes, governance, and cost optimization across multiple cloud providers. “Single pane of glass” management, seamless movement across infrastructure platforms and “cloudbursting” are unlikely to become reality, even between providers using the same underlying CIF or with use of portable application container technology. <- This is an interesting one … Everyone in the Kubernetes community will probably not agree – because that is exactly what so many organizations are hoping that Kubernetes will give them, their holy grail of Cloud Agnostic..

Note that the claim that an ecosystem is “open” has nothing to do with actual portability. Due to the high degree of differentiation between providers, the organizations that use cloud IaaS most effectively will embrace cloud-native management, rather than allow the legacy enterprise environment to dictate their choices.

“Lift and shift” migrations rarely achieve the desired business outcomes. Most customers who simply treat cloud IaaS like “rented virtualization” do not achieve significant cost savings, increased operational efficiency or greater agility. It is possible to achieve these outcomes with a “lift and optimize” approach — cloud-enabled virtual automation — in which the applications do not change, but the IT operations management approach changes to be more automated and cloud-optimized. Customers who execute a lift-and-shift migration often recognize, after a year, that optimization is needed. Gartner believes it is more efficient to optimize during the migration rather than afterward, and that customers typically achieve the best outcomes by adopting the full range of relevant capabilities from a hyperscale integrated IaaS+PaaS provider. <- This is exactly what all the cloud vendors are selling, Start with lift and shift – and then go all in

What Key Market Aspects Should Buyers Be Aware Of?

The global market remains consolidated around two clear leaders. The market consolidated dramatically over the course of 2015. Since 2016, just two providers — AWS and Microsoft Azure — have accounted for the overwhelming majority of the IaaS-related infrastructure consumption in the market, and their dominance is even more thorough if their PaaS-related infrastructure consumption is included as well. Furthermore, AWS is many times the size of Microsoft Azure, further skewing the market structure. Most customers will choose one of these leaders as their strategic cloud IaaS provider.Chinese cloud providers have gone global, but still have limited success outside of the domestic Chinese market. The sheer potential size of the market in mainland China has motivated multiple Chinese cloud providers to build a broad range of capabilities; such providers are often trying to imitate the global leaders feature-for-feature. While this is a major technological accomplishment, these providers are primarily succeeding in their domestic market, rather than becoming global leaders. Their customers are currently China-based companies, international companies that are doing business in China and some Asia/Pacific entities that are strongly influenced by China. <- The Chinese market is just this – a Chinese market

AWS

Provider maturity: Tier 1. AWS has been the market pioneer and leader in cloud IaaS for over 10 years.

Recommended mode: AWS strongly appeals to Mode 2 buyers, but is also frequently chosen for Mode 1 needs. AWS is the provider most commonly chosen for strategic, organization wide adoption. Transformation efforts are best undertaken in conjunction with an SI. <- This does not mean that you can’t do it on your own – you definitely can – but you will sweat blood and tears getting there.

Recommended uses: All use cases that run well in a virtualized environment.

Strengths

AWS has been the dominant market leader and an IT thought leader for more than 10 years, not only in IaaS, but also in integrated IaaS+PaaS, with an end-of-2017 revenue run rate of more than $20 billion. It continues to aggressively expand into new IT markets via new services as well as acquisitions, adding to an already rich portfolio of services. It also continues to enhance existing services with new capabilities, with a particular emphasis on management and integration.

AWS is the provider most commonly chosen for strategic adoption; many enterprise customers now spend over $5 million annually, and some spend over $100 million.<- No-one said that cloud is cheap – on the contrary.

While not the ideal fit for every need, it has become the “safe choice” in this market, appealing to customers that desire the broadest range of capabilities and long-term market leadership.AWS is the most mature, enterprise-ready provider, with the strongest track record of customer success and the most useful partner ecosystem. Thus, it is the provider not only chosen by customers that value innovation and are implementing digital business projects, but also preferred by customers that are migrating traditional data centers to cloud IaaS. It can readily support mission-critical production applications, as well as the implementation of highly secure and compliant solutions. Implementation, migration and management are significantly eased by AWS’s ecosystem of more than 2,000 consulting partners that offer managed and professional services. AWS has the broadest cloud IaaS provider ecosystem of ISVs, which ensures that customers are able to obtain support and licenses for most commercial software, as well as obtain software and SaaS solutions that are preintegrated with AWS. <- which is exactly why they have been, are and will probably stay the market leader

Provider maturity: Tier 1. GCP benefits, to some extent, from Google’s massive investments in infrastructure for Google as a whole.

Recommended mode: GCP primarily appeals to Mode 2 buyers. <- Google is for the new stuff, don’t want no stinking old legacy

Recommended uses: Big data and other analytics applications, machine learning projects, cloud-native applications, or other applications optimized for cloud-native operations.

Strengths

Google’s strategy for GCP centers on commercializing the internal innovative technology capabilities that Google has developed to run its consumer business at scale, and making them available as services that other companies can purchase. Google’s roadmap of capabilities increasingly targets customers with traditional workloads and IT processes, as well as with cloud-native applications. Google has positioned itself as an “open” provider, with a portability emphasis that is centered on open-source ecosystems.<- hell yeah – they are the ones that gave the world Kubernetes

Like its competitors, though, Google delivers value through operations automation at scale, and it does not open-source these proprietary advantages.

GCP has a well-implemented, reliable and performant core of fundamental IaaS and PaaS capabilities — including an increasing number of unique and innovative capabilities — even though its scope of services is not as broad as that of the other market leaders. Google has been most differentiated on the forward edge of IT, with deep investments in analytics and ML, and many customers who choose Google for strategic adoption have applications that are anchored by BigQuery.

Google can potentially assist customers with the process of operations transformation via its Customer Reliability Engineering program (currently offered directly to a limited number of customers, as well as in conjunction with Pivotal and Rackspace). The program uses a shared-operations approach to teach customers to run operations the way that Google’s site reliability engineers do.

Microsoft

Provider maturity: Tier 1. Microsoft’s strong commitment to cloud services has been rewarded with significant market success.

Recommended mode: Microsoft Azure appeals to both Mode 1 and Mode 2 customers, but for different reasons. Mode 1 customers tend to value the ability to use Azure to extend their infrastructure-oriented Microsoft relationship and investment in Microsoft technologies. Mode 2 customers tend to value Azure’s ability to integrate with Microsoft’s application development tools and technologies, or are interested in integrated specialized PaaS capabilities, such as the Azure Data Lake, Azure Machine Learning or the Azure IoT Suite.

Recommended uses: All use cases that run well in a virtualized environment, particularly for Microsoft-centric organizations.

Strengths

Microsoft Azure’s core strength is its Microsoft heritage — its integrations (both current and future) with other Microsoft products and services, its leverage of the existing Microsoft ISV ecosystem, and its overall strategic importance to Microsoft’s future. Azure has a very broad range of services, and Microsoft has steadily executed on an ambitious roadmap. Customers that are strategically committed to Microsoft technology generally choose Azure as their primary cloud provider. <- This! This is the primary reason why Microsoft has come up in the Cloud in the past few years and why they will continue to push hard on Amazon’s heels. They are the one and only Cloud provider with a complete and true hybrid story

Microsoft Azure’s capabilities have become increasingly innovative and open, with improved support for Linux and open-source application stacks. Furthermore, many customers that are pursuing a multicloud strategy will use Azure for some of their workloads, and Microsoft’s on-premises Azure Stack software may potentially attract customers seeking hybrid solutions. <- Having spent a few days a week or two ago on the Microsoft campus – this is unbelievably true, They are a completely different company – and for the better.

So there were significant changes from the number of participants from last year – many vendors were left out. Here are the changes in the Inclusion and Exclusion criteria – which probably caused the shift.

2018

Market traction and momentum. They must be among the top global providers for the relevant segments (public and industrialized private cloud IaaS, excluding small deployments of two or fewer VMs). They must have ISO 27001-audited (or equivalent) data centers on at least three continents. They must have at least one public cloud IaaS offering that meets the following criteria:

- If the offering has been generally available for more than three years: A minimum of $250 million in 2017 revenue, excluding all managed and professional services; or more than 1,000 customers with at least 100 VMs.

- If the offering has been generally available for less than three years: A minimum of $10 million in 2017 revenue, excluding all managed and professional services, as well as a growth rate of at least 50% exiting 2017.2017

Market traction and momentum. They must be among the top 15 global providers for the relevant segments (public and industrialized private cloud IaaS, excluding small deployments of one or two VMs), based on Gartner-estimated market share and mind share

2018

Technical capabilities relevant to Gartner clients. They must have a public cloud IaaS service that is suitable for supporting mission-critical, large-scale production workloads, whether enterprise or cloud-native. Specific generally available service features must include: •

- Software-defined compute, storage and networking, with access to a web services API for these capabilities.

- Cloud software infrastructure services facilitating automated management, including, at minimum, monitoring, autoscaling services and database services.

- A distributed, continuously available control plane supporting a hyperscale architecture.

- Real-time provisioning for compute instances (small Linux VM in five minutes, 1,000 Linux VMs in one hour) and a container service that can provision Docker containers in seconds.

- An allowable VM size of at least 16 vCPUs and 128GB of RAM.

- An SLA for compute, with a minimum of 99.9% availability.

- The ability to securely extend the customer’s data center network into the cloud environment.

- The ability to support multiple users and API keys, with role-based access control.

The 2018 inclusion criteria were chosen to reflect the key traits that Gartner clients are seeking for strategic cloud IaaS providers, and thus reflect minimum requirements across a range of bimodal use cases.2017

Technical capabilities relevant to Gartner clients. The public cloud IaaS service must be suitable for supporting production workloads, whether enterprise or cloud-native. Specific service features must include:

- Data centers in at least two metropolitan areas, separated by a minimum of 250 miles, on separate power grids, with SSAE 16, ISO 27001 or equivalent audits Real-time provisioning (small Linux VM in five minutes)

- The ability to scale an application beyond the capacity of a single physical server An allowable VM size of at least eight vCPUs and 64GB of RAM

- An SLA for compute, with a minimum of 99.9% availability

- The ability to securely extend the customer’s data center network into the cloud environment

- The ability to support multiple users and API keys, with role-based access control

- Access to a web services API

So I think it is really sneaky that Gartner changed their criteria – and probably what pulled most of the players out of the game was the part about containers and the rest of the managed services. Some were also probably pushed out because of the revenue. They are very much still alive – they are very much still making money but it is clear who is the boss, who is hot on their heels, and who is going to picking up the scraps.

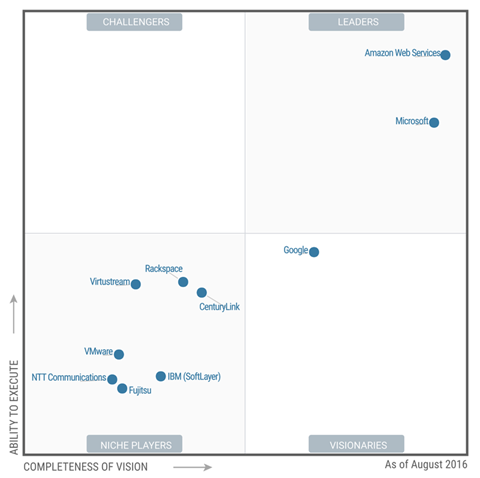

Here are the quadrants – year after year